Honeywell’s Connected Technologies to Boost Growth Prospects – Honeywell

Through its Honeywell Connected Aircraft Report released yesterday, Honeywell International Inc. HON indicated a high probability of huge investments being made by airlines in the commercial aviation industry on connected technologies in the years ahead. This anticipation is primarily based on the rising need for high-speed Wi-Fi connectivity within the aircraft.

Connected technologies help enhancing passengers’ experience by maximising easy flow of data from and to the aircraft as well as on-time arrival and heightened security assurances. It is also beneficial for operators and pilots in terms of landing and navigation, tracking fuel usage of the fleet, providing weather information and many such more facilities.

Maintenance is a common concern for airlines as unfortunate issues can jeopardize take-off and landing timings. It can cost airlines a lot and also adds to flyer-dissatisfaction. These issues can be largely addressed via predictive maintenance, made possible with the applications of connected technologies. In addition, a check on fuel consumption as well as aircraft turnaround time is possible with the aid of connected technologies.

Per the Honeywell Connected Aircraft Report – result of a survey of 106 aviation professionals – nearly 95% of the respondents is ready to pump resources into connected aircraft within five years. Talking of investments, nearly 50% of professionals is ready to spend up to $1 million (preferably $100,000-$500,000) to equip one aircraft with connected technologies by next year. Roughly 38% of respondents is prepared to spend at least $1 million per aircraft in the coming five years.

This survey clearly points toward enhanced business opportunities for Honeywell. The company has been strengthening its connected technology portfolio, offering in excess of 100 products and services related to connected technologies.

Additionally, Honeywell launched a gas metering solution yesterday, namely Honeywell Connected Plant Measurement IQ for Gas. This solution will assist in monitoring midstream gas +metering systems.

Zacks Rank & Other Key Picks

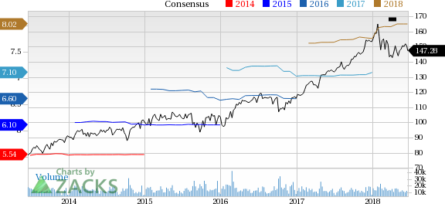

With a market capitalization of nearly $110 billion, Honeywell currently carries a Zacks Rank #2 (Buy). The company’s Zacks Consensus Estimate is pegged at $8.02 per share for 2018 earnings, reflecting 0.5% growth from the past 60-day-ago tally while the same for 2019 remained stable at $8.79.

Honeywell International Inc. Price and Consensus

Honeywell International Inc. Price and Consensus | Honeywell International Inc. Quote

In the past year, shares of Honeywell have yielded 9.7% return, outperforming 17% fall in the industry it belongs to.

Some other top-ranked stocks in the industry are Raven Industries, Inc. RAVN , Crane Company CRand Federal Signal Corporation FSS . While Raven sports a Zacks Rank #1 (Strong Buy), both Crane and Federal Signal carry a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here .

In the last 60 days, earnings estimates for the above three stocks improved for the current year. Also, an average earnings surprise for the trailing four quarters was a positive 9.78% for Raven, 2.13% for Crane and 16.07% for Federal Signal.

Today’s Stocks from Zacks’ Hottest Strategies

It’s hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 – 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we’re willing to share their latest stocks with you without cost or obligation.